What is the maximum amount of the order in 2021 to Aliexpress per month from Russia: customs restrictions, limits and duties for purchases for Ali Express. How much did the customs tax on purchases from Russia in 2021 pay on Aliexpress and how much?

In this article we will discuss what amounts can be ordered to Aliexpress per month and what customs restrictions and limits apply.

Contents.

- What customs restrictions act on purchases from Aliexpress in 2021?

- Payment of customs duty for parcel with Aliexpress

- How to avoid customs duties for the package with Aliexpress?

- What is the amount of order per month with Aliexpress from China to Russia not subject to customs duties in 2021?

- How much did the customs tax on purchases from Russia in 2021 pay on Ali Extress and how much?

- Video: Custom import tax in 2021: Aliexpress, ComputerUniverse, Alibaba, eBay

Aliexpress always famous for low prices for goods, respectively, it attracted those who decided to do business and sell goods from China. It must be said that it is really profitable, as prices are sometimes twice as low as usual. In this case, the question arises - is there any restrictions on the number of ordered goods on Aliexpress. Let's figure it out.

What customs restrictions act on purchases with Aliexpress in 2021?

All restrictions on international shipments are governed by the Customs Service.

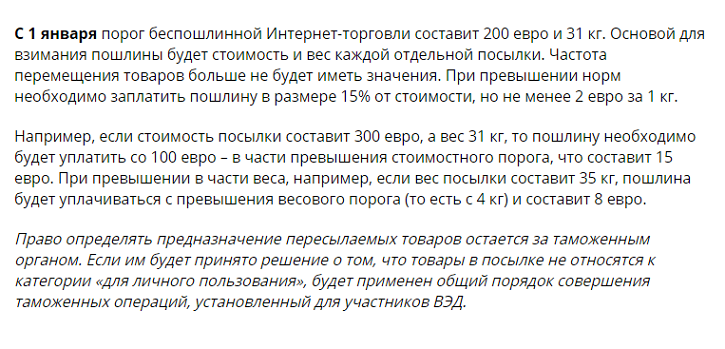

So, according to the official rules from January 1, 2020 and in 2021, you can order goods to Russia from China without having to pay for the duty to the amount 200 euros or no more 31 kg For one place. And on the number, the cost and weight of parcels per month of restrictions are absent. Order how much you need, but within the standard for one parcel.

When leaving the limit, you will have to pay extra. The size of the duty at customs is 15% from the amount, exceeding the limit, but not smaller 2 Euro for one kilogram Excess weight. In addition, you will have to pay when cramming 500 rubles CustomsIf the parcel is delivered by private carriers, express delivery or a low postal commission for delivery by mail. But the postal commission can not pay if the duty will pay online.

The duty is paid in the case of commercial procurement, to which customs can attribute several identical things in one shipment or a party of the same product on one person.

Payment of customs duty for parcel with Aliexpress

Payment duty is assigned to the buyer Aliexpress. Payment is usually in the post office on a special form. This is something like cash on delivery. So, until you pay, it will not take the goods.

Either such a form will present a courier if he brings the parcel. And he is given money.

Sometimes you can make the payment online if you have a SMS, or an email with reference to the payment form.

How to avoid customs duties for the package with Aliexpress?

To avoid this overpayment It is possible if you divide the order into two parcels within the standard of 200 euros and 31 kg of weight.

In addition, if you ordered a lot of the same type of goods, the time check time It will increase, since the parcel can recognize the commercial, that is, the order is made in order to further sell things, and not for personal use. Therefore, always ask the seller to put in one package not more than 3-4 units of the same product if you buy by parties.

What is the amount of the order per month with Aliexpress From China to Russia is not subject to customs duties in 2021?

As we said, without a duty, the sum of one order with Aliexpress make up 200 euros, without limiting the number of orders per month. Although, in fact, it can be more, but then you have to pay.

With what amount on Aliexpress Customs pays tax on purchases from Russia in 2021 and how much?

Customs duty is paid when the limit is exceeded in 200 euros For one postal departure with Aliexpress in Russia and it is 15% from that amount that is in excess of Limit. If there is an excess of the limit by weight, then you will have to pay for 2 Euro For each extra kilogram.

Additionally, it is worth noting that if both limit are exceeded, then the tax will be paid for one limit in the amount that will turn out to be more.

For example, for the weight of a duty of 4 euros, and for the cost of 3 euros. Then the amount for payment of 4 euros. And of course a customs or postal collection plus.